The Hidden Forces Shaping Our World

First off, economics isn’t just for the buttoned-up Wall Street types analyzing interest rates all day. Nope. Economics is a set of tools that helps us make sense of our weird, often irrational human behaviors. Forget the textbook jargon — economics is that sneaky force shaping everything from our coffee orders to why your neighbor won’t shut up about his crypto investments. It’s less about market graphs and more about how and why we make decisions, even the small, seemingly random ones.

Take housing agents, for example. They sell their own homes with way more care than when they’re listing other people’s. Weird, right? But think about it: they’re applying their insider knowledge, choosing the optimal time to list, the right buyer to accept. When selling other people’s homes? Not quite the same hustle. Hidden incentive structures at play.

The Power of Incentives

If economics had a mascot, it’d be a big foam “I” for Incentives. Incentives move the world, people. And not just the obvious “pay me more, and I’ll work harder” kind. We’re talking about three main categories of incentives that make us tick:

- Financial Incentives – Cold, hard cash. Give people a financial reward, and they’ll usually put in extra effort. Tell them there’s a fine for being late to pick up their kids, though, and sometimes they’ll just show up later because now there’s a price on it. (True story: daycare centers tried this and saw tardiness increase. Go figure.)

- Social Incentives – Think of this as the “what will people say?” factor. Social incentives make us behave, more or less, in ways that align with what’s expected by the group around us. Want proof? Just watch how much less people tip in a restaurant with no visible tip jar.

- Moral Incentives – These are driven by personal values. It’s why some people volunteer for hours without pay and others choose eco-friendly products even if they cost more. But let’s be real: moral incentives are only as strong as the actual guilt someone feels about breaking them.

Real-life examples? Besides the late-fee daycare fiasco, there’s the “honor system” coffee station at some offices. You’d think people would toss a dollar in for their coffee every time. But no, some folks conveniently forget, showing how social dynamics can actually shape behavior as much as dollar signs.

Market Forces in Action

Alright, let’s cut to the core of economics: supply and demand. Picture this as a dance between what’s available (supply) and how much people want it (demand). When these two are in sync, prices stabilize. When they’re not, things get wild.

Case in point: let’s talk about illegal markets — high-risk, high-reward, right? Prices initially skyrocket because goods are rare. But as more suppliers jump in to grab a slice, prices start dropping. Eventually, competition hits, pushing prices even lower. That’s supply and demand doing its thing, albeit with a sketchy product and higher stakes. It’s a fascinating (if illegal) example of economic theory in motion.

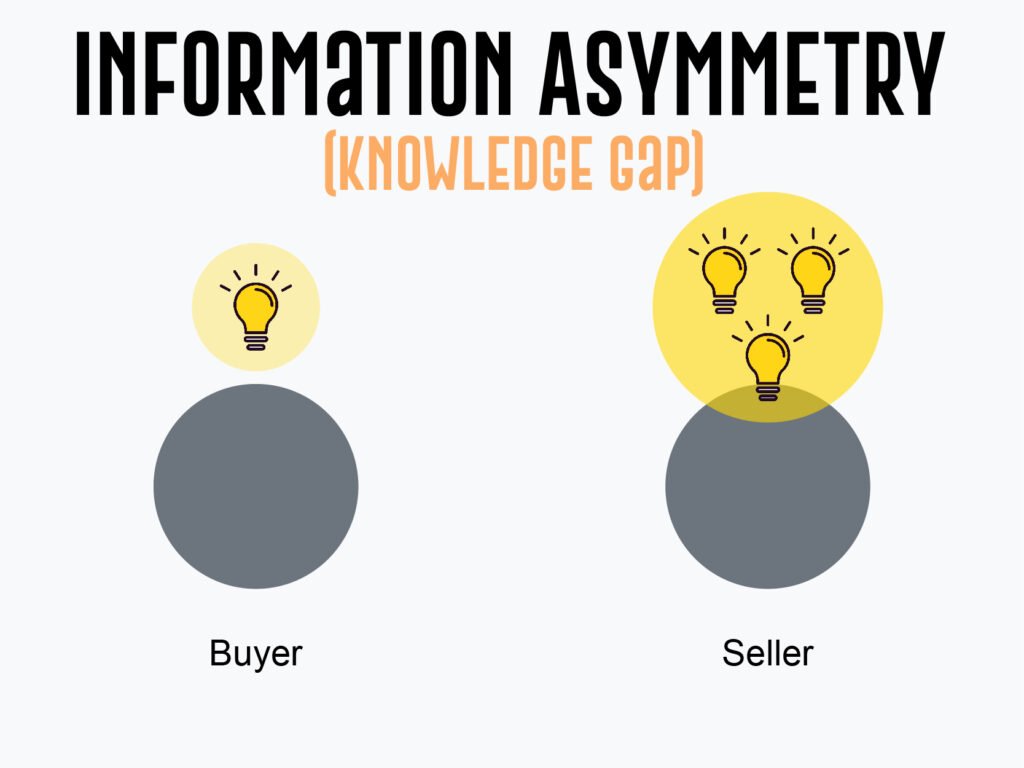

Knowledge Imbalances in Transactions

Ever notice how some people always seem to get a better deal? That’s because they know something you don’t — welcome to information asymmetry.

The classic example? Real estate agents. They know the ins and outs, like where to find buyers and the best times to sell. They have an upper hand in every transaction, and they know it. But information gaps don’t just favor the pros. Even regular people benefit from the internet leveling the playing field. With endless data at our fingertips, we’re closing those gaps faster than ever.

Want to pay less for a car? Google average prices. Buying a house? Research recent sales in the area. Suddenly, you’re not as much at the mercy of the “expert.” Knowledge is power, and the internet is the great equalizer — sometimes.

Challenging Popular Assumptions

Here’s where things get spicy. Economics, and the data that fuels it, often flips our assumptions on their heads.

Take the crime drop in the 1990s. Many people thought it was because of better policing. The reality? A complex blend of factors, including increased access to abortion in the ‘70s, which led to fewer unwanted children growing up in challenging circumstances. Or election spending — does throwing more money into campaign ads guarantee a win? Spoiler: no, not always. Sometimes, the data defies our neat, comforting explanations.

Data-Driven Insights

This is the part where data analysts geek out. They look for patterns in things most people don’t even consider. With the right data, we start to see things differently — demographics tied to crime patterns, the financial backbone of black markets, or why certain products fly off the shelves and others gather dust.

For instance, analysts might study demographic data on crime and find out it’s not as straightforward as people think. Or they’ll look at underground economies, revealing surprising patterns about who’s buying what and why. All this data, properly crunched, gives us insights that challenge simple assumptions and show the complexity behind basic choices.

Applying Economic Analysis to Daily Life

Now here’s where it gets fun. Imagine if you started thinking like an economist about your own choices. Here are a few ways to sharpen those analytical skills:

- Opportunity Costs – Every time you choose to do one thing, you’re giving up something else. Economists call this the “cost” of missed opportunities. Next time you’re about to waste an hour on a streaming binge, ask what else you could be doing with that time. Opportunity cost, folks.

- Unintended Consequences – It’s not just about “what will happen,” but “what else will happen” because of your choice. Sometimes doing a favor for a friend means setting yourself up for endless free help requests.

- Recognizing Cognitive Biases – Your brain has shortcuts that sometimes lead to bad decisions. For example, confirmation bias makes you focus on info that supports your pre-existing beliefs. Not helpful when you’re making important life choices. Just like in economics, it pays to question your biases.

Economics as a Universal Tool

Ultimately, economics isn’t just about markets or stock prices. It’s a lens, a way of understanding human behavior, decisions, and outcomes. The choices we make every day — from buying groceries to deciding on a job change — are mini-economic decisions. Each choice is driven by our own incentives, shaped by our knowledge (or lack thereof), and influenced by external forces like supply and demand.

And here’s the kicker: once you get comfortable seeing these patterns, you realize they’re everywhere. You don’t have to be an economist to see the way these “hidden forces” shape every aspect of life. Just pay attention to the incentives around you, watch how supply and demand sway your choices, and don’t let anyone sell you the “magic” of economics without the context. There’s no crystal ball here, just data, choices, and a bit of strategic thinking.

In summary, economics isn’t some remote science — it’s just an epic, sometimes absurd way of looking at our day-to-day life. Use it well, and you might just spot hidden patterns where others see chaos.